What is PEPPOL

PEPPOL enables businesses to exchange documents, such as purchase orders and invoices, in a standardised format between their financial systems. With all required fields on the screen filled in, data arrives in the trading partner’s software complete and ready for processing.

As a result, e-Invoicing immediately reduces the rate of exceptions. Currently, 10-45% of all paper-based invoices have to be treated as exceptions. This means staff need to spend time investigating the exception and resolving it, adding to the cost of processing and lengthening payment times. Typically, across categories such as Contested payments, Processing exceptions, Data Accuracy and Time related exceptions.

Through improved data quality and more efficient delivery, e-Invoicing enables:

- a higher rate of straight-through processing,

- quicker payment times, and

- lower operating costs.

The ATO predicts that by switching to e-Invoicing, trading partners will share savings of around $21 per invoice in the costs of issuing and processing paper-based invoices. Extrapolated across the economy, the Government says savings could amount to $28 billion over the next decade.

E-Invoicing reduces the cost of doing business, which frees up working capital for companies to do more. It also makes it easier for Australian and New Zealand businesses on the PEPPOL network to trade with each other.

What does it mean for your business?

If your trading partners are government agencies or large businesses, you may be encouraged (or even obliged) to switch to e-Invoicing as soon as possible. The Government had mandated that all Commonwealth agencies will transition to PEPPOL by 1 July 2022, with all the larger ones doing so by 1 July 2021. Wider use of PEPPOL is still one of the ATO targets in 2024.

In 2022, Australia proposed a Business E-invoicing Right (BER) initiative to encourage wider business adoption of Peppol e-invoicing. Under this proposal, businesses are legally obliged to adopt and send e‑invoices if requested by their customers.

Australian Treasury recently announced plans to legislate this initiative, and this will be introduced in a phased approach on the following schedule:

- First year: Companies can require their large suppliers (with annual turnover AUD 50 million) to provide Peppol e-invoices.

- Second year: Companies can require their medium-sized suppliers (with annual turnover between AUD 10 million and 50 million) to provide Peppol e-invoices.

- Third year: Companies can require all their suppliers, regardless of size and turnover, to provide Peppol e-invoices.

The Treasury originally proposed implementing the first phase of BER in July 2023.

However, the date has been postponed and there are no clear timelines available yet.

To encourage widespread adoption of PEPPOL e-Invoicing, the Government has said that it will pay supplier e-Invoices up to the value of $1 million within five business days or pay interest on them. With many small and medium-sized businesses struggling with cash flow, this is an attractive offer: Currently, 53% of payments from large businesses to small businesses are late.

“The implementation of PEPPOL e-invoicing across all Commonwealth agencies is a testament to our commitment to digital transformation. We have worked diligently with businesses and software providers to ensure a smooth transition, and the positive impact on payment times and error reduction is already evident.” – Debra Walton, Chief Digital Officer

The Government’s mandate is designed to accelerate the roll out of PEPPOL across the nation. After all, for e-Invoicing to have a transformative effect on the economy it needs to be in widespread use. But for individual businesses that make the transition, they will enjoy benefits regardless; buyers and sellers will achieve:

- efficiency gains,

- cost savings, and

- reduced risk of fraud.

Data is transferred quickly, easily and safely through the PEPPOL network. The exchange is very secure because all trading partners need to be registered and authenticated on the network by an access point provider. These services are provided by software companies who need to be approved by the ATO in Australia and the Ministry of Business Innovation and Employment in New Zealand PEPPOL and meet and maintain strict cyber security standards.

How does PEPPOL work?

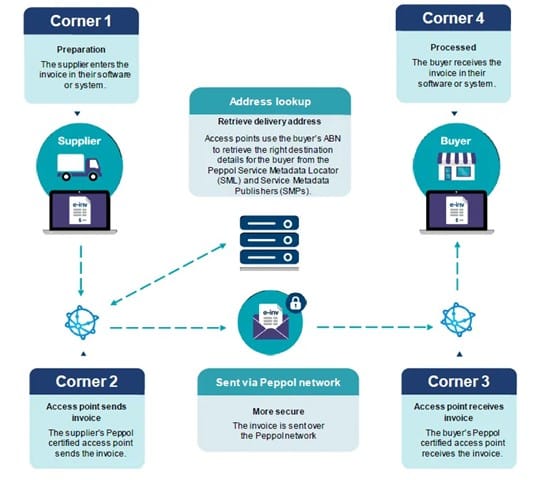

PEPPOL operates as a 4-corner model as shown:

The network sits between corners 2 and 3. Buyers can only receive invoices through one access point provider, whereas invoice issuers can send through several access point providers according to their business structure and needs. Larger companies, for example, may have many business units with sales departments, and several ERP and accounting systems in use.

The sender’s access point (corner 2) will use the buyer’s ABN and the PEPPOL Service Metadata Locator (SML) and Service Metadata Publishers (SMPs) to retrieve the correct destination details for the customer. Therefore, the supplier does not need to know what finance system its buyer has in place; if the buyer is registered to receive PEPPOL e-Invoices, they will receive the data into their system. If they are not registered to receive e-Invoices, the sender’s access point will notify the invoice issuer and provide a back-up option of sending the invoice via email attachment.

The 4-corner model is significant because it allows businesses of all sizes and differing requirements to participate on the network at low cost. This contrasts with an Electronic Data Interchange (EDI) system that has a 3-corner structure (supplier, buyer and network operator), which is expensive to access.

Large trading partners often impose EDI on their supply chain to digitalise the exchange of business documents, improve communication and limit manual processes. The costs involved can, however, prohibit small and medium-sized businesses from trading with large organisations. Ultimately, this negatively impacts both companies.

What are the costs involved with PEPPOL?

The costs of PEPPOL e-Invoicing will depend on the solutions that the businesses opt for to gain access to the network. Many times, the functionality will be incorporated into the systems they are already using; other times it may be appropriate to invest in new software solutions. Learn how PEPPOL has helped Small Businesses and Local Government Authorities navigate the e-invoicing landscape to gain cost efficiencies.

Things to consider

When selecting a PEPPOL access point provider, it’s worth considering whether the solution offered continues to fulfil your current – as well as upcoming – needs. Initially there will be a period of transition and it may not be ideal to run two processes simultaneously.

For example:

- Does the e-Invoicing solution also allow you to process paper and digital invoices?

- Does it allow you to set business rules to manage approvals and exceptions?

- Does it capture a complete audit history of all invoices that enter your organisation?

What do you want to achieve?

For many businesses, the way forward is to decide what your needs are with regards to sending and receiving invoices. From this standpoint you can find the service provider that offers the best functionality to meet your requirements.

E-Invoicing provides the potential to transform the business-to-government and business-to-business landscape in Australia, providing tangible economic benefits on both a micro and macro level. Let’s embrace a digital future and see where it takes us as a nation. Learn more about how Efficiency Leaders can help you get e-invoicing enabled.